When changing insurance, there are a few points to consider, otherwise there will be expensive or the insurance change may not be effective, so that in the worst case the insurance cover erlischt. November 30th (yesterday) was the key date for 95% of all policyholders by which the old policy had to be canceled. The savings with a successful change can be partly three digits fail. However, there are some mistakes that are commonly made in connection with changing insurance and that it is is to be avoided.

1. Missing deadlines

If you want to cancel your car insurance, you have to do so at least four weeks before the next main due date to do. The main maturity date is the day on which the new insurance year begins, unless otherwise agreed, on 1. January. This results in the November 30th as the reference date for termination. The termination must be on this day with the insurance company, while the postmark is irrelevant for this. Tip: In the event of premium increases, the customer has a special right of termination. However, this also provides for a period of four weeks, which begins with the receipt of the annual invoice and the associated premium increase.

If you want to cancel your car insurance, you have to do so at least four weeks before the next main due date to do. The main maturity date is the day on which the new insurance year begins, unless otherwise agreed, on 1. January. This results in the November 30th as the reference date for termination. The termination must be on this day with the insurance company, while the postmark is irrelevant for this. Tip: In the event of premium increases, the customer has a special right of termination. However, this also provides for a period of four weeks, which begins with the receipt of the annual invoice and the associated premium increase.

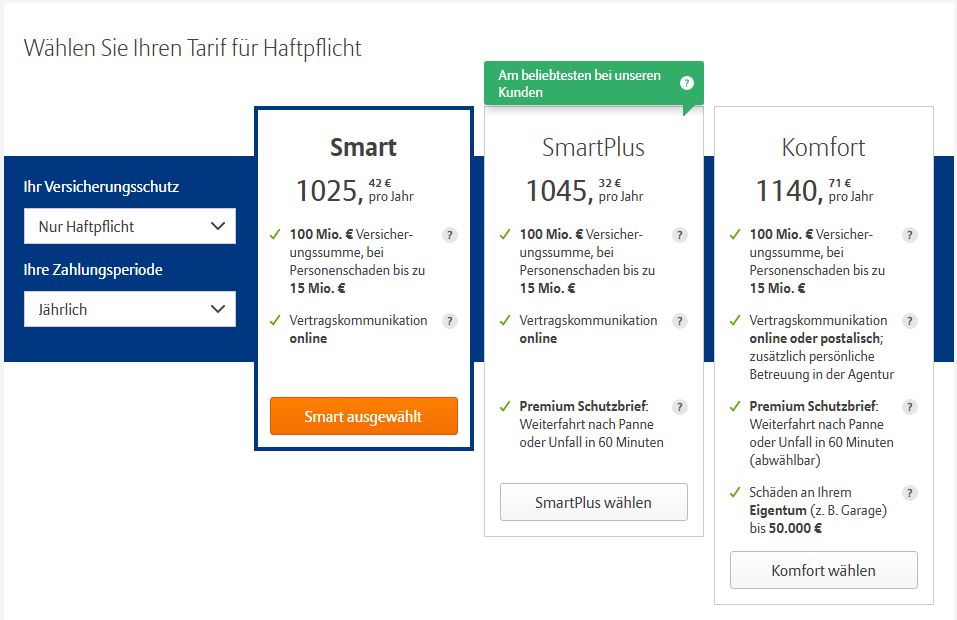

2. Cheaper doesn't always mean better

When changing insurance, it is important not just the price, but also the ones offered Services to compare with each other. A good price can quickly blind you and you don't see that important services maybe are not covered, and in the event of damage, the costs remain with the insured. So z. B. with marten bites the consequential damage can often be considerably more expensive than the damage directly caused by the marten. However, it is by no means the case with every comprehensive insurance the consequential damage also insured, which can lead to the fact that you are left with this damage if necessary.

Tip: When comparing insurance, always compare the current contract and its services with the new contract.

Also a shorter period for replacement value compensation can cost the insured dearly. in case of a Total loss shall the new value and the current value of the insured vehicle is not reimbursed. However, the time periods for this agreement can vary greatly. So there are running times between six and 24 months before. One cannot imagine how annoyed one is when this happens and one is left with a loss in the high four-digit or maybe even five-digit range just to save 100 euros. After all, that's when it comes to new cars in the first two years the loss of value is highest.

3. Avoid unfavorable downgrade

If you had an insurance claim with your old insurance company last year, you will be in the no-claims class for the coming year downgraded. A change of insurance also changes this nothing. On the contrary, it actually increases the risk that you will be downgraded even further as each insurer has its own downgrade tables. In the worst case, this can mean that you might not just have an SF class, but different loses, which in turn is associated with higher costs. For many, this is often only fatal after the change the insurance company clear as the comparison calculator the current no-claims discount use. To avoid a rude awakening here, be sure to check the respective Compare downgrade tables. Calling the new provider can also be helpful.

4. Ensure that the information is complete and correct

Information that you should provide to your insurance company discord to the best of our knowledge and belief correct and complete especially if you came across the offer via a comparison calculator. On the one hand, if you do not provide any information, you could miss out on various discounts and, on the other hand, there is a risk of conflicts with the insurance company in the event of a claim. This means that they can impose a contractual penalty on them or claim lost contributions retrospectively.

5. Avoid formal errors when terminating

A termination can ineffective will if they Form defects having. For example, refer to expressly a special right of termination if you terminate as a result of a premium increase. If you do not note this and your cancellation is only received after November 30th, the insurance company can refuse the cancellation and you are still bound by your old contract. They also belong Number of the insurance policy and the registration number of the vehicle in the termination.

6. Failure to make initial payment

When taking out new insurance, a date is set by which the first payment can be made must be available. Usually 14 days are here from receipt of the insurance policy set. If the payment is not made on time, this can jeopardize the insurance cover. The insurance company is obliged to point this out again, but you can save yourself that, especially since the insurance company will check your entitlement to benefits very carefully if the first payment is delayed. In case of doubt, this can also lead to legal proceedings.

Are you planning to buy a new car and are you therefore looking for financing? Or should the modified baby and its attachments simply have the best possible insurance? Then ours Credit, financing, leasing, insurance & Co. categories exactly the right place to go to get information. And also cheap financing for Accessory parts is there. Is the new one forged wheel, the planned Airride air suspension or the one you want foiling too expensive? Then a little one might help Financing in the process of implementing the modification on the vehicle. And also the topic Leasing or the vehicle sales are not neglected here. Just click through the posts and get the answer to your questions.

Of course, that wasn't the end of it!

tuningblog has countless posts on the topic Credit, financing, leasing, insurance & Co. in stock. Do you want to see them all? Just click HERE and look around. The following is an excerpt from the last contributions from this category:

"Tuningblog.eu" - we keep you up to date on the subject of car tuning and car styling with our tuning magazine and we present you the latest tuned vehicles from all over the world every day. It's best to subscribe to ours Feed and will automatically be informed as soon as there is something new about this post, and of course also to all other contributions.

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car