Recently updated on November 19, 2020 at 11:21 am

[Display]

1. Your credit rating determines whether you can get a car loan!

If you have a bad credit rating, you may be rejected by credit institutions for a car loan. Therefore, you should inform yourself in advance exactly which entries are stored in your credit rating file and how they are composed.

2. Your credit rating determines the credit terms!

Your credit rating also determines the conditions on which you get a car loan. The better your credit rating, the lower the conditions / interest! This means that you can save a lot of money with a good credit rating. If you have a bad credit rating, you usually have to pay higher interest rates. In extreme cases, this can even lead to a loan refusal.

Your credit rating also determines the conditions on which you get a car loan. The better your credit rating, the lower the conditions / interest! This means that you can save a lot of money with a good credit rating. If you have a bad credit rating, you usually have to pay higher interest rates. In extreme cases, this can even lead to a loan refusal.

3. Check which data is stored about you at credit agencies!

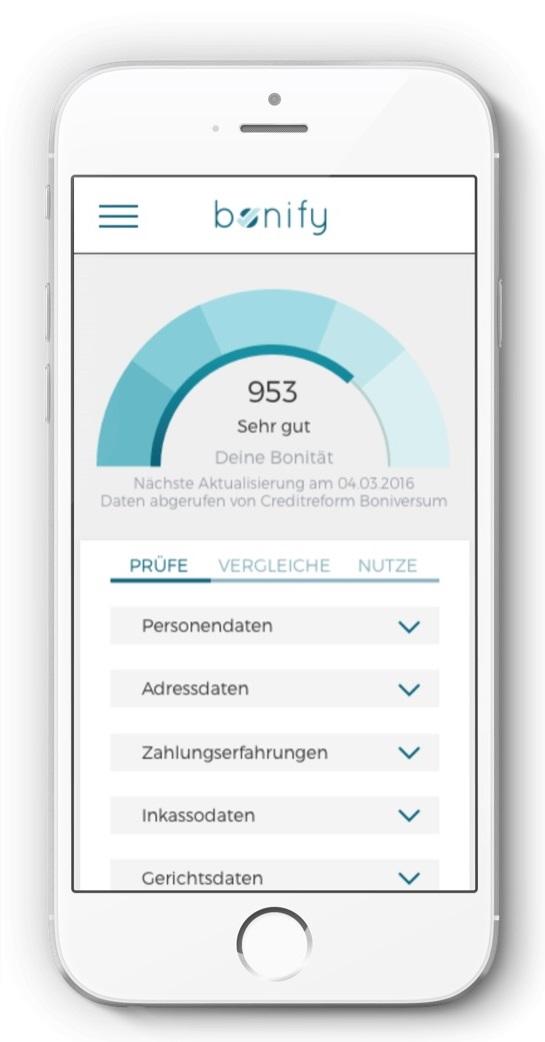

In order to have control over your data, you should inform yourself which data have an influence on your creditworthiness! These are, for example, personal data, payment experience, collection and court data, insolvency proceedings as well as company shares and existing credit obligations.

4. Your credit rating can be wrong!

About a third of the credit information is incorrect, outdated or incomplete. This can wrongly negatively affect your credit rating. If you discover a wrong entry in your credit rating, you have the right to immediate correction! It is also important to keep an eye on the deletion periods. If the deletion period for entries has expired, this can improve your creditworthiness! Only complete and correct data lead to a fair credit rating!

How to find your perfect car loan:

You can use the bonify product offer to get the ideal installment loan for your car finance! At bonify, our matching algorithm suggests the perfect loan for which you have already pre-qualified - matching your individual creditworthiness and financial situation. You benefit from a fast online process and can also save money thanks to the optimal conditions.

You can use the bonify product offer to get the ideal installment loan for your car finance! At bonify, our matching algorithm suggests the perfect loan for which you have already pre-qualified - matching your individual creditworthiness and financial situation. You benefit from a fast online process and can also save money thanks to the optimal conditions.

An overview of all advantages of bonify:

✓ Free credit check and optimization

✓ Free financial management tool

✓ Account alerts to monitor account movements

✓ Individualized loan offers

Are you curious? Then register now for free on bonify.de and find out how your creditworthiness is and whether you qualify for a loan!

"Tuningblog.eu" - we keep you up to date on the subject of car tuning and car styling with our tuning magazine and present you the latest tuned vehicles from all over the world every day.

It's best to subscribe to ours Feed and will automatically be informed as soon as there is something new for this post, and of course also to all other contributions.

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car