The so-called type class stands for a basis of the calculation of the motor insurance. On the basis of this, the insurance premiums for motor vehicle liability and comprehensive insurance can be calculated. And the new type class ratings for 2022 have already been determined. The classifications were issued by the German Insurance Association (GDV). Then apply to more than seven million drivers new and partly also higher Classifications. The respective type classes reflect the vehicle balance sheet of the vehicle type and are updated every year. If the respective balance deteriorates or if the classification is higher than in the previous year, this leads to higher contributions. Conversely, a lower rating also means lower costs. The GDV recently announced the new type class classifications for the year 2022.

2022 higher type class classifications

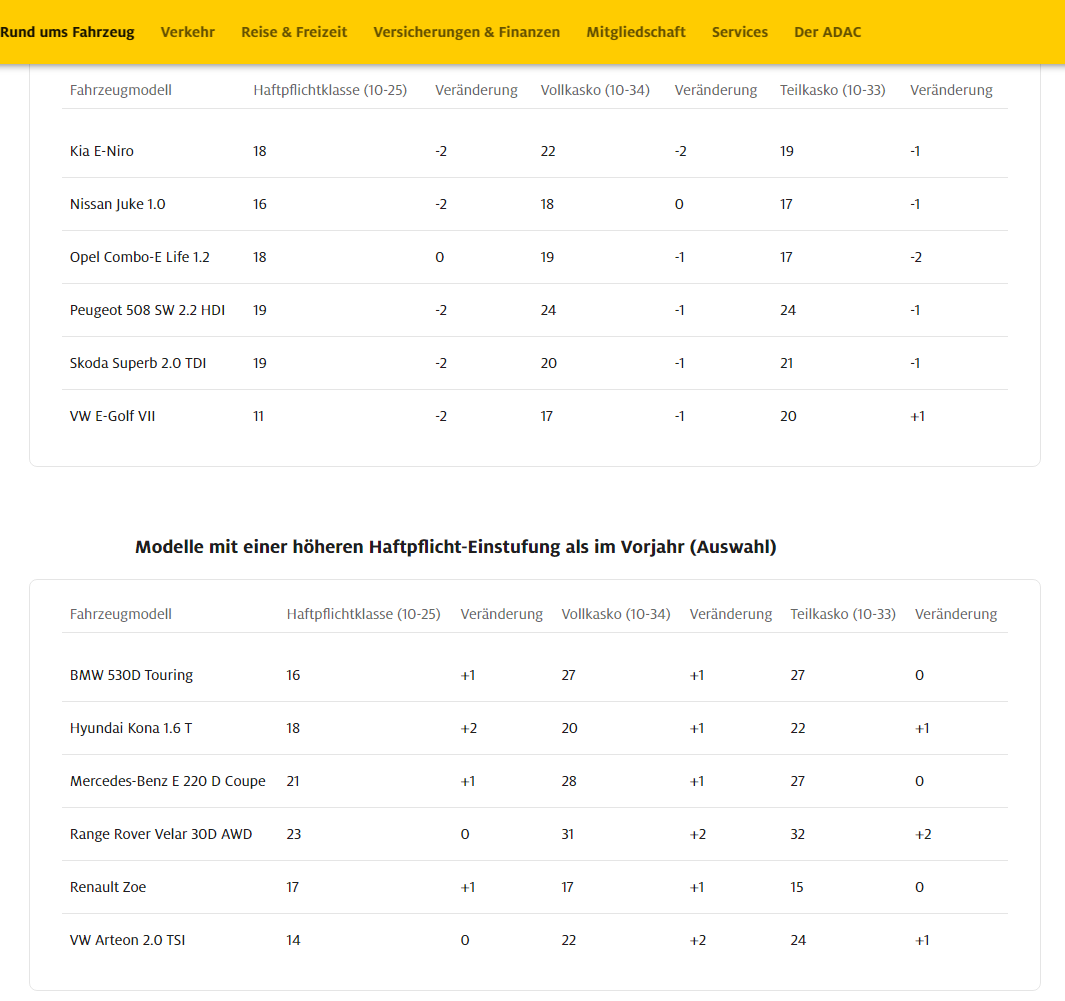

Around 4,3 million drivers are driven by one better ones Benefit from type class in motor vehicle liability insurance. For more than seven million drivers, however, apply higher Classifications. Three quarters, or almost 30,3 million drivers, benefit from the same type class from the previous year. And also with the new calculation it becomes clear that a big jump in the type class is rather the exception. Because only a few models change by more than one class up or down. For example: Has your vehicle model from 2018 to 2021 many reported repairs received, then it will probably be in a land high type class 2022.

Improvements:

- Nissan Juke 1.0 - Type F16 since 2019

- VW E-Golf VII - type AU since 2016

The vehicle models mentioned structures each by two type classes.

Deterioration:

- Hyundai Kona 1.6 T - Type OS since 2017

This vehicle model in turn deteriorates by two type classes. On the website dieversicherunger.de Incidentally, the corresponding type class can be used for each vehicle determined .

Type classes in comprehensive insurance

According to the GDV, around three percent of the vehicles (corresponds to around 660.000 cars) one higher and again around 40 percent (corresponds to 9,5 million cars) one lower Classification. The situation in partially comprehensive insurance is different: here, around four percent (corresponds to around 490.000 vehicles) in a higher Type class, while it is 32 percent (corresponds to 4,1 million vehicles) are which in a lower Be classified as type class.

In motor vehicle liability insurance they are Benefits for opponents involved in an accident decisive - the difference: In comprehensive insurance, among other things the value of the insured car. This is the reason why many high-powered upper-class models and SUVs are classified in rather high type classes, while the older models and small cars mostly benefit from lower classes.

This is how the type classes are calculated

The calculation basis is provided by the last three years For this period, the corresponding damage and the resulting costs are considered. In other words, if the damage reports and the costs incurred have decreased compared to the last calculation, this means that a classification in a lower Type class takes place. In contrast, an increase in the number of damage reports and costs incurred means a higher Classification in the type class.

The motor vehicle liability insurance is characterized by 16 different type classes from (classes 10 to 25), in partial insurance there are 24 classes (classes 10 to 33) and in fully comprehensive insurance there are even 25 classes (10 to 34). Only Oldtimer are classified in the motor vehicle liability insurance in the cheapest class (corresponds to class 10), as they are seldom driven and are particularly protected by the owner. In contrast, the popular entry-level models are often positioned in higher type classes, as novice drivers are also more likely to suffer sheet metal damage.

Increase in the type class in terms of insurance costs

Because of the new classifications, car insurance can cover 30 percent of vehicle owners either cheaper or more expensive will. However, only the following changes are affected here, which have an increase or decrease in several classes or the change in liability and comprehensive insurance comes together.

An example: The Opel Corsa F 1.2 receives a four levels higher Type class. Verivox's model calculation shows that the costs for motor vehicle liability insurance have increased by 29 percent. This results in an additional amount of 80,31 euros. In this case, the driver is 45 years old, comes from Kiel and has no damage class 5.

Another example in comparison: The current Suzuki Jimny receives an order six steps lower Type class in fully comprehensive insurance. Verivox's model calculation shows that the costs for fully comprehensive insurance are reduced by 30 percent. This comes one Savings of 152,96 euros same.

Verivox state that the risk of damage in new car models only estimate leaves. Therefore, there are initially large jumps in the type class classification, which is less the case with the older vehicle models. But big jumps are rather rare. As already mentioned, the type class of the vehicles usually only changes by one level up or down. Financially, this is expressed in a contribution that has changed by around 10 percent.

Special right of termination in the event of a premium increase

The Premium increase depends on several factors. This not only affects the reclassifications in the type class, but also any changes to the Regional classes as well as cheaper no-claims classes. For example, due to the corona pandemic, there is a lower mileage, this can be reported to the insurance company. This may lower the premium. And there are also some car insurers who even overpaid premiums in retrospect reimburse. One should not forget, by the way, also general ones Price adjustments the insurer can cover the costs increase or decrease. Incidentally, insured persons always have a special right of termination and can change insurance. A cost reduction is often the result when switching. The following is an exemplary overview, provided by ADAC.

Contribution to car insurance - composition!

The insurance premium for motor vehicle liability and comprehensive insurance (partial and fully comprehensive) is influenced by several factors. These include the regional and type classes (are determined annually based on current data) even individual criteria like discount features. For example the Mileage of the vehicle, the high of excess (more SB lowers the insurance premium), the Age from the vehicle when buying, parking in a Garage, the Freedom class, which People use the vehicle and that too Age from the driver.

Are you planning to buy a new car and are you therefore looking for financing? Or should the modified baby and its attachments simply have the best possible insurance? Then ours Credit, financing, leasing, insurance & Co. categories exactly the right place to go to get information. And also cheap financing for Accessory parts is there. Is the new one forged wheel, the planned Airride air suspension or the one you want foiling too expensive? Then a little one might help Financing in the process of implementing the modification on the vehicle. And also the topic Leasing or the vehicle sales are not neglected here. Just click through the posts and get the answer to your questions.

Of course, that wasn't the end of it!

tuningblog has countless posts on the topic Credit, financing, leasing, insurance & Co. in stock. Do you want to see them all? Just click HERE and look around. The following is an excerpt from the last contributions from this category:

|

Car purchase, car subscription & leasing in direct comparison! |

Vehicle classes: the vehicle categories exist in the EU / Germany |

"Tuningblog.eu" - we keep you up to date on the subject of car tuning and car styling with our tuning magazine and we present you the latest tuned vehicles from all over the world every day. It's best to subscribe to ours Feed and will automatically be informed as soon as there is something new about this post, and of course also to all other contributions.

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car