In the future, automated driving functions expected lead to less damage to vehicles. Nevertheless, the compensation payments from motor vehicle insurers will only be slightly lower by 2040. Cars are becoming safer due to the increasing spread of assistance systems, that's absolutely true. According to a new study by the General Association of the German Insurance Industry (GDV), this leads to less damage and thus to lower compensation payments from insurers. For the next two decades, the authors of the study “Automated Driving – Impact on Claims Expenditure by 2040But only with one moderate decline of expenses.

According to the study: hardly any relief potential!

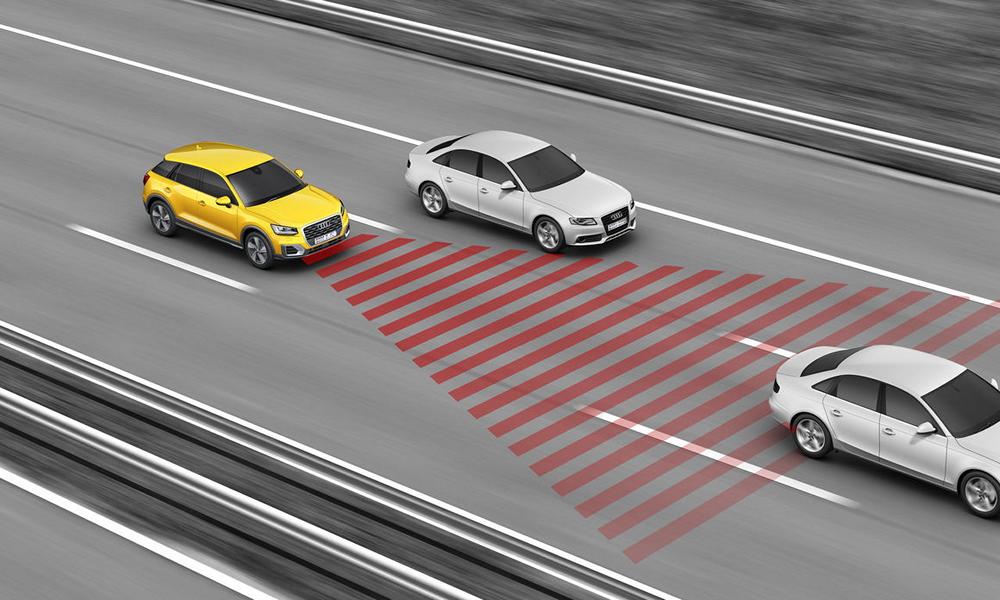

Compared to the total output of 25 billion euros in 2019, a decrease of only 12 percent forecast. In the case of liability insurance in particular, the compensation could increase 17 percent decrease, while for comprehensive insurance – which regulates damage to your own car – only a decrease of 7 percent is expected. Parking and maneuvering assistants, emergency brake assistants, lane keeping and lane change assistants, so-called "highway pilots" and similar systems for city and country roads are examples of helpers who can prevent vehicle damage. The report cites several reasons for the only very moderate decline. The study has shown that aids such as a motorway pilot cannot influence types of damage such as marten bites or stone chips. And under real conditions, such as bad weather, the automatic systems also prevent less damage than in theory. Ground: they just don't work as reliably as expected.

According to the study: Technology spreads slowly!

The study also assumes that the systems will spread only slowly. Two scenarios were calculated: Based on the introduction of ABS system in the 70s, it is assumed that the spread will be rather slow: after 20 years, the technology is expected to be installed in around 40% of cars. The slightly faster scenario is based on the introduction of the ESP system from 1995: According to this scenario, after 20 years the new technology will be installed in about 80% of the cars. As the example of the windshield shows, technology also increases the cost of repair services, which are 25% more expensive in cars with assistance systems. Finally, the authors of the study predict that the number of automobiles in Germany will continue to rise and will reach 2040 million insured vehicles by 46,5.

https://www.youtube.com/watch?v=e5cJpNJ7-24

Are you planning to buy a new car and are you therefore looking for financing? Or should the modified baby and its attachments simply have the best possible insurance? Then ours Credit, financing, leasing, insurance & Co. categories exactly the right place to go to get information. And also cheap financing for Accessory parts is there. Is the new one forged wheel, the planned Airride air suspension or the one you want foiling too expensive? Then a little one might help Financing in the process of implementing the modification on the vehicle. And also the topic Leasing or the vehicle sales are not neglected here. Just click through the posts and get the answer to your questions.

Of course, that wasn't the end of it!

tuningblog has countless posts on the topic Credit, financing, leasing, insurance & Co. in stock. Do you want to see them all? Just click HERE and look around. The following is an excerpt from the last contributions from this category:

|

No fault in the accident? Then be careful with the opposing insurance company! |

"Tuningblog.eu" - we keep you up to date on the subject of car tuning and car styling with our tuning magazine and we present you the latest tuned vehicles from all over the world every day. It's best to subscribe to ours Feed and will automatically be informed as soon as there is something new about this post, and of course also to all other contributions.

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car