In our post, like a Car loan can be tax deductible and in the article "Tachograph/tachograph“ we more or less briefly discussed the regulations on the subject 1%, logbook & Co. dealt with. But now there was a legitimate question from one of our readers, on the topic "the logbook edition applies also for replacement vehicles"? Specifically, Harald K asks: "As a sole proprietor I am planning to rent a car for 3 to 4 weeks as I have to work on site at a client. I don't own a car myself. Do I have to post the costs for the rental car to account 4595 for third-party vehicle costs? And what about the cost of fuel? To account 4673 for travel expenses? And it's not quite clear to me from how many weeks/months in this case logbook respectively the 1% rule comes into play? And then one last question: How do I book the costs and on which accounts if the logbook or the 1% rule applies?“We can say about that. That basically in the accounting treatment in the SKR03 no difference between the company's own vehicle and a (short or long term) rented vehicle. Therefore, the operational costs for the vehicle must be posted to account 4595, third-party vehicle costs, and the fuel costs to 4530 for ongoing vehicle operating costs. And the vehicle will too used privately, then you have to delimit the private part in this case as well. It is possible to use the 1% method or to use a logbook to calculate the number of kilometers driven. In the case of a rental vehicle / replacement vehicle, however, the kilometer method with the logbook should probably make more sense.

"Logbook edition" also for the replacement vehicle

By the way, a "logbook edition" determined by the regulatory office must be not necessarily only refer to the vehicle in the notice with which the traffic violation occurred at the time, but extends Auch to a possible replacement vehicle. However, not in general! If the vehicle is used for a short time / temporarily, such as the replacement vehicle for repairs, then this will be deducted from the logbook edition not included (Judgment OVG Lüneburg / decision of April 30.04.2015, 12, Az.: 156 LA 14/XNUMX). And one more piece of information. The vehicle owner cannot avoid an imposed logbook requirement for a specific vehicle simply because the "criminal vehicle" may have been leased and has now been returned. The condition is then transferred to the new vehicle for the period specified by the office. Only if he finally gives up his keeper status and no longer owns a new vehicle, then the logbook edition is void.

All information on this page is for general information. They do not constitute legal advice in individual cases and cannot and should not replace them. They are for general information only and in particular do not constitute legal advice for individual cases

Of course, that wasn't the end of it.

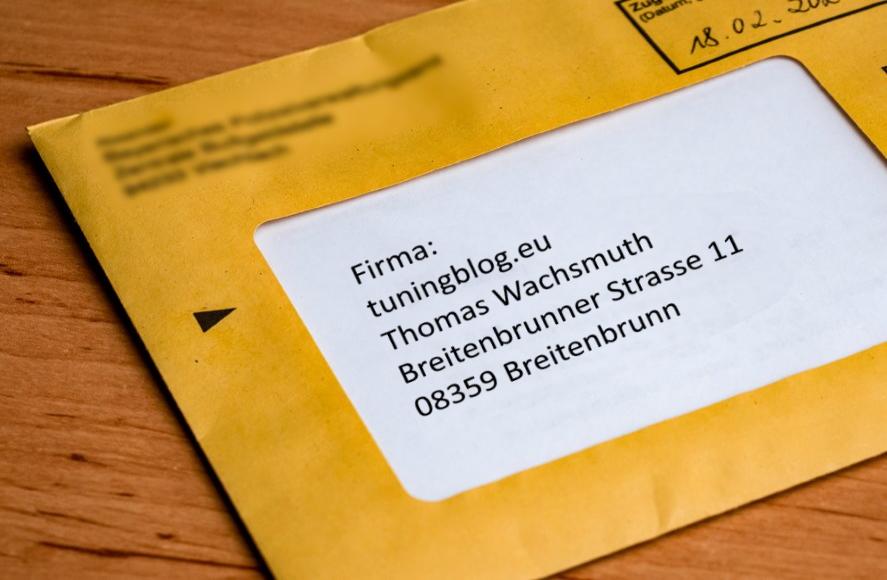

tuningblog.eu has a lot of other articles on the subject of auto & tuning in stock. Do you want to see them all? Just click HERE and look around. But also planned changes in the law, violations in road traffic, current regulations in the field of STVO or on the subject inspection we would like to inform you regularly. Everything you can find in the category "Test sites, laws, offenses, information". Following an excerpt of the last information:

|

Military on the road: This is how you should react as a driver! |

"Tuningblog.eu" - we keep you up to date on the subject of car tuning and car styling with our tuning magazine and we present you the latest tuned vehicles from all over the world every day. It's best to subscribe to ours Feed and will automatically be informed as soon as there is something new about this post, and of course also to all other contributions.

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car