Recently updated on September 21, 2021 at 08:21 am

There is also the possibility for novice drivers to reduce the cost of car insurance. Anyone who registers their first car and has to take care of a car insurance will know the problem. The Car insurance costs are significantly higher for novice drivers than for other long-term drivers. Insuring your own car yourself is not a worthwhile decision. Various possibilities, which are explained below, reveal a bit of circumventing this.

Insurance: offers for novice drivers!

Who is only interested in very specific areas around the topic "Car Insurance! Favorable offers for novice drivers!" iIf you are interested, you can use the following jump labels to navigate directly to the desired topic with just one click. And just as quickly you can return to this overview from the selected menu item with just one click. However, we recommend our readers to always read through the entire article. Some menu items are only really comprehensible and understandable once the complete information article has been read.

Who is only interested in very specific areas around the topic "Car Insurance! Favorable offers for novice drivers!" iIf you are interested, you can use the following jump labels to navigate directly to the desired topic with just one click. And just as quickly you can return to this overview from the selected menu item with just one click. However, we recommend our readers to always read through the entire article. Some menu items are only really comprehensible and understandable once the complete information article has been read.

- Parents second car

- Family bonus motor insurer

- Transfer of discounts

- accompanied driving

- Choosing a cheap type class

- Review of services

- Almost 5.000 euros for an old VW Golf?

- Take out insurance by the end of June

- Avoid downgrading

- Compare offers

All of these possibilities can mean that high contributions for novice drivers can be avoided. The high costs are due to the classification in the Freedom class 0because the insurance company cannot yet assess the risk of accidents for the insured person and the insured person therefore has to pay the full contributions. A Reclassification in a cheaper no-claims class it is only possible after 3 yearsif a certain driving experience has been gained during this time. So here the point mentioned above is worthwhile, that the driving experience has a Parents second car is collected, but they also pay more contributions if a person under 25 years the car is leading. The reason for this is that, statistically speaking, young people cause more accidents than experienced drivers. So what options do you have to reduce car insurance costs?

Second car regulation via the parents

The most common is probably the second car regulation via the parents who use the child's car own second car Sign in. That bypasses that No claims class 0 starts and gives the novice driver the opportunity to do the necessary 3 years of driving experience to collect. With persistent Accident-free further discounts are acquired and a few years later the car can be transferred to the child if this is desired.

Family bonus from insurers

Since car insurance companies are willing to win new customers, most of them have a so-called one Family bonus. For example, if a family member is insured with an insurance company, the child or a any other family member Get insurance on improved terms with no-claims discounts. There is also potential for savings here and a certain amount for insurance and the insured Win-win situation present.

Transfer of the no-claims bonus

SF class transmission is one of the most popular, but also the most complicated, solutions for novice drivers. However, here are basically more discounts possiblethan the other options. The SF class can be used by insured persons transfer will. This is possible for spouses or relatives or family members (parents / children, grandparents / grandchildren). However, in total only as much discount can be transferred as the acceptor himself could have achieved in the time.

Case study: The novice driver has had his driving license for 5 years and can therefore take over SF class 5 from the family member, regardless of which SF class the family member was classified in. The novice driver must on top of that have had a driver's license for at least 6 months and the transfer cannot be done immediately with the acquisition of the driving license. So you could go directly instead of in the SF class 0 with SF class ½ begin. But attention: If discounts are transferred to family members, they can do so themselves can no longer be used. A common method of transfer is therefore rather between grandparents and Grandchild the rule. The reason for this is that in many cases the grandparents no longer own or drive a car. It is only important that the last vehicle is deregistered no longer than 7 years behind. From the 8th year the discounts of the motor insurance expire. Here you should sit down with the insurance company and explore the various options.

Driving license at 17 - accompanied driving

The driver's license test has been possible for several years at the age of 17. The basic requirement for this is that up to the age of 18 only accompanied driving is possible. This means that a registered person must sit next to the underage driver. The advantage is that this has advantages the contributions of the car insurance and numerous insurance companies can provide participants with one Bonus occupy. The reason for this is that participants of the accompanied driving seen statistically less accidents cause.

Choosing a cheap type class

Not only the driving experience of the insured person, also that Type class of the vehicle determines the amount of the car insurance contribution. The classification is based on a damage balance in Type classeshow many damage from certain vehicle types caused. The amount of the premium also depends on which car or motorcycle is purchased. Vehicle models that are listed as Beginner models are known rather unfavorable type classes. So specifically, it is a VW Golf, an Opel Astra or a Ford Focus. To the service charges To keep it as low as possible, one should therefore consider the Type classes inform and see which models are the cheapest in the type classes. Sometimes a used Audi A6, an Opel Insignia or a Ford Mondeo can actually be cheaper. But it always depends on the type of vehicle. The insurance gives this at any time before the purchase Information desk.

The general insurance benefit

In addition to the independent factors, the insured can always choose the appropriate ones Insurance benefits which you should make depending on the vehicle. A Comprehensive insurance is always the most expensive option, but it also covers most cases of damage. Depending on the Current value of the vehicle do. If this is low, one is sufficient in many cases Partial insurance or the normal one Automobile liability. For example, if a novice driver starts with the SF class 0 With a Comprehensive insurance in road transport, the cost can be in the four-digit range climb. However, if you own a vehicle with a high current value, you should not do without it. Here you should coordinate exactly which vehicle and which associated insurance is actually necessary. As you can see, something like this should always be considered very carefully.

More than 5.000 euros for a used VW Golf?

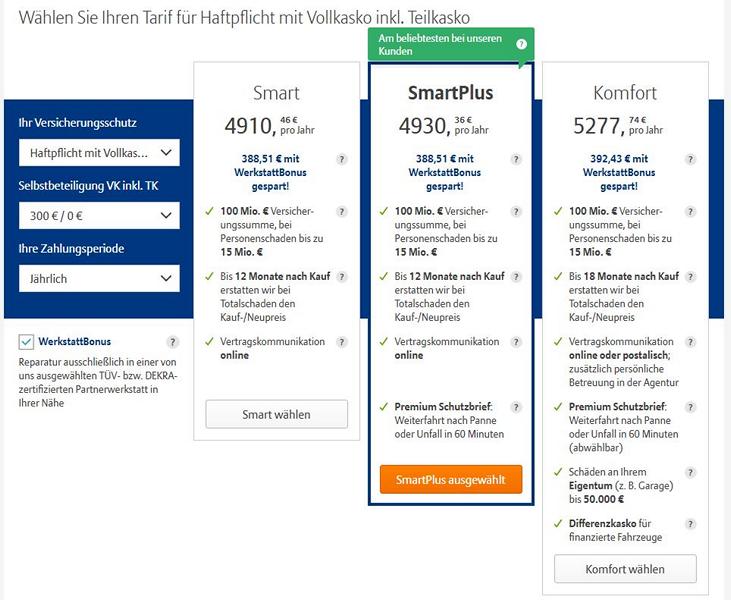

1 example: You were born in 2002, have not taken part in the “Accompanied Driving from 17” (BF17) program, are a vehicle owner in postcode area 08 ... and have financed a 2003 VW Golf with 150 hp. If you drive approx. 15 tkm per year, do not specify an additional driver, choose liability with fully comprehensive insurance and do not have an SF class, then according to the online calculator with annual payment and 300 SB at Allianz insane € 4.930 per year due. The car itself is unlikely to be worth more than € 2.000. If any. Of course, this calculation is one of the worst, but it should show what insurance can cost per year.

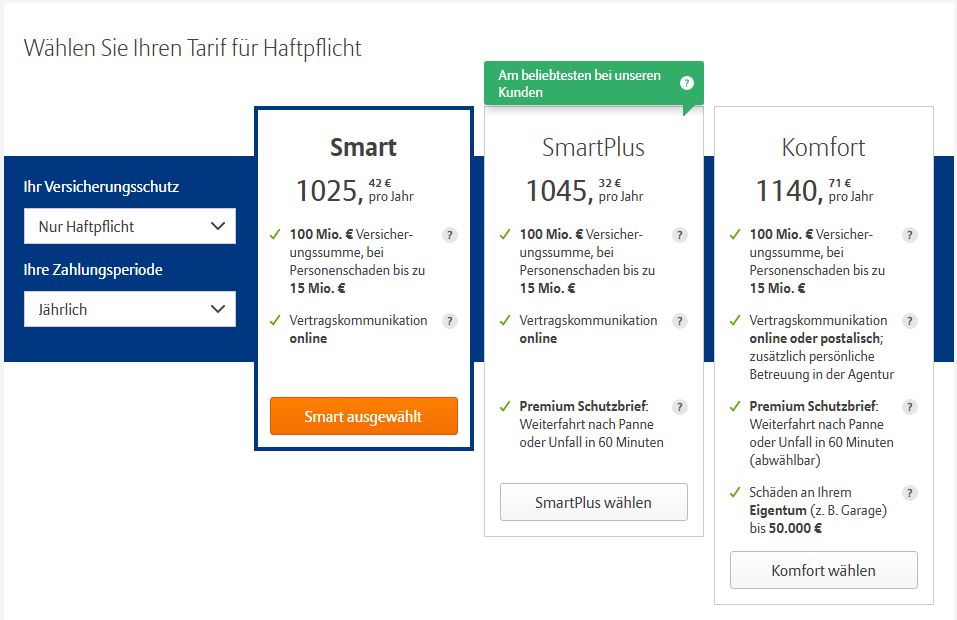

2 example: You were born in 2002, have taken part in the “Accompanied driving from 17” (BF17) program, are a vehicle owner in postcode area 08 ... and have bought an Opel Karl 1.0 Easytronic with 75 hp in cash. If you drive approx. 10 tkm per year, do not specify an additional driver, one Telematics app use only Liability choose and take over an SF-5 (44%), then according to the online calculator with annual payment at Allianz € 1.025 due per year. A clear difference compared to the example above, which can certainly even be reduced significantly with various comparisons on the usual portals. Of course, this calculation is a relatively favorable constellation, but it should show how cheap insurance can be in the year.

2 example: You were born in 2002, have taken part in the “Accompanied driving from 17” (BF17) program, are a vehicle owner in postcode area 08 ... and have bought an Opel Karl 1.0 Easytronic with 75 hp in cash. If you drive approx. 10 tkm per year, do not specify an additional driver, one Telematics app use only Liability choose and take over an SF-5 (44%), then according to the online calculator with annual payment at Allianz € 1.025 due per year. A clear difference compared to the example above, which can certainly even be reduced significantly with various comparisons on the usual portals. Of course, this calculation is a relatively favorable constellation, but it should show how cheap insurance can be in the year.

Registration by the end of June

Another tip is that the vehicle should at best be in the first half of the year is registered. The reason is that the insurance contract must exist for at least 6 monthsto move to a cheaper SF class to be classified. When registering in the second half of the year you would have to accordingly 1,5 years can SF class 0 pay.

Avoid downgrading

In the first few years it is important to have as little as possible to do with insurance. If smaller Sheet metal damage occur, it will be cheaper in the long term to pay for the damage yourself and pay for it accordingly Downgrade to avoid. Even who is still in the SF class 0 is should be careful, because even here is a downgrade to the so-called SF class M possible (for malus).

Comparison of insurance offers

Last but not least, you should always have the Compare insurance offers. The recommendation is that you always have one comparison calculator which not only reveals percentages, but above all also those actual costs. Of course, this is always a prerequisite truthful statement. A comparison on one of the large platforms showed that the unfavorable constellation from our Example 1 from above, instead of just under € 5.000 at the cheapest insurer, costs “only” € 1.709 here. Still a hefty amount considering the insured vehicle, but already over 50% cheaper. As everywhere in life, it is also worthwhile with insurance: Compare!

Are you planning to buy a new car and are you therefore looking for financing? Or should the modified baby and its attachments simply have the best possible insurance? Then ours Credit, financing, leasing, insurance & Co. categories exactly the right place to go to get information. And also cheap financing for Accessory parts is there. Is the new one forged wheel, the planned Airride air suspension or the one you want foiling too expensive? Then a little one might help Financing in the process of implementing the modification on the vehicle. And also the topic Leasing or the vehicle sales are not neglected here. Just click through the posts and get the answer to your questions.

Of course that had not happened yet!

tuningblog has countless posts on the topic Credit, financing, leasing, insurance & Co. in stock. Do you want to see them all? Just click HERE and look around. The following is an excerpt from the last contributions from this category:

|

Motor vehicle insurance - contribution repayment due to Corona? |

"Tuningblog.eu" - we keep you up to date on the subject of car tuning and car styling with our tuning magazine and we present you the latest tuned vehicles from all over the world every day. It's best to subscribe to ours Feed and will automatically be informed as soon as there is something new about this post, and of course also to all other contributions.

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car