Recently updated on September 23, 2023 at 05:48 am

[Display] The cost of the car market has been rising for some time, so that buyers have to dig significantly deeper into their pockets to afford a new or used car. There are many different reasons for buying a car. Whether it's a change in life situation, an accident or the switch to more comfort - anyone who is looking around for a car quickly realizes that the purchase will involve some costs.

A professional explains how very simple methods can save a lot of money when planning to buy a car. There are very different options that can significantly reduce expenses. In the following article you will find five professional tips that can save you up to 30 percent when buying a new or used car.

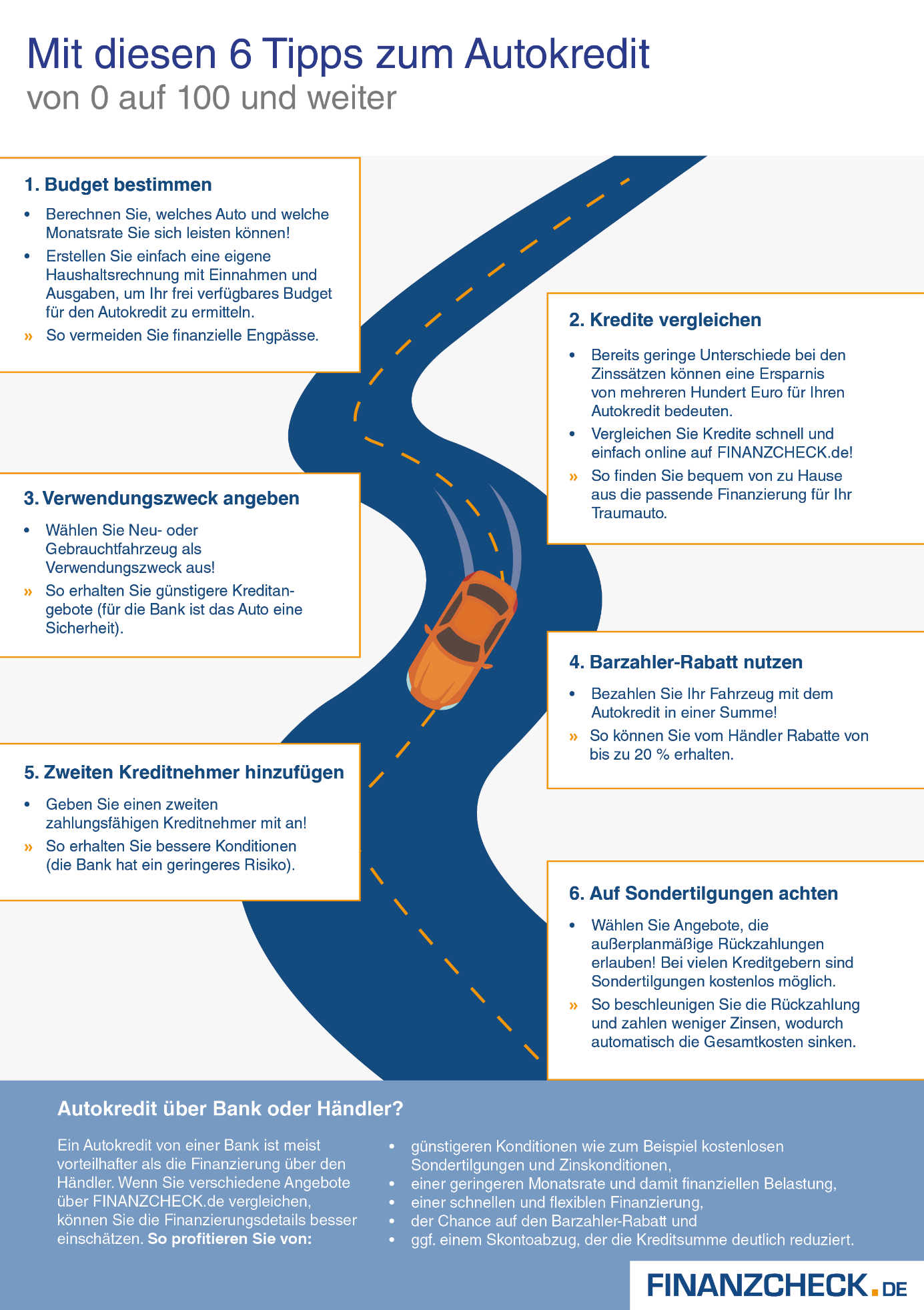

Tip 1: Secure a cheap car loan!

A car loan is a convenient way to make a car purchase a reality. Consumers now have a large selection of different car loans on the Internet. In order to be able to find a cheap car loan, it is advisable to compare some loan offers with each other. Depending on the desired loan amount, loan term and repayment installments, the conditions can vary greatly. Accordingly, one should check several offers for different framework conditions at the same time. In any case, it is worthwhile to opt for a short term in order to keep borrowing costs low.

Tip 2: Receive special conditions as a cash payer!

Dealers also grant loans to customers. But the conditions in a car dealership are significantly worse than on the free credit market. Anyone who secures an independent loan offer can benefit from a lower interest rate. In addition, it is possible to appear as a cash payer in the negotiations. Paying cash when buying a car can result in savings of up to 20 percent. Dealers are therefore willing to give big discounts if a car can be paid for directly on site. But it applies to cash purchases ensure a secure purchasing process. If possible, a cash purchase should not be made alone and should only be made with a receipt and purchase contract.

Tip 3: Thoroughly inspect the car

With a little expertise and an eye for defects, you can save a lot of money. Is a Planned used car purchase, a trained eye can quickly determine the condition of a car. After a thorough check of the engine compartment, the body and the interior, you should definitely take a test drive. Found deficiencies can be used later in price negotiations.

Tip 4: Add a second borrower

In order to save money when taking out a loan, it may be worthwhile to rely on a second borrower. Your life partner or a close family friend can help keep the costs of the car loan low, especially if the loan amounts are larger. The lender receives additional security in the event of non-payment. With an additional loan guarantor, interest rates can be reduced enormously.

Tip 5: Insist on special repayments when borrowing

Unscheduled repayments are a great advantage for borrowers, so you should not do without various special repayments in the loan agreement. A premature repayment of the loan debt means a low interest burden here, so that the loan costs can be easily reduced. In most cases, special repayments are available free of charge.

Are you planning to buy a new car and are you therefore looking for financing? Or should the modified baby and its attachments simply have the best possible insurance? Then ours Credit, financing, leasing, insurance & Co. categories exactly the right place to go for information. And also cheap financing for Accessory parts is there. Is the new one forged wheel, the planned Airride air suspension or the one you want foiling too expensive? Then a little one might help Financing in the process of implementing the modification on the vehicle. And also the topic Leasing or the vehicle sales are not neglected here. Just click through the posts and get the answer to your questions.

Of course, that wasn't the end of it!

tuningblog has countless posts on the topic Credit, financing, leasing, insurance & Co. in stock. Do you want to see them all? Just click HERE and look around. The following is an excerpt from the last contributions from this category:

other related posts

|

Why is motor vehicle liability insurance compulsory in Austria? |

|

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car