Recently updated on September 22, 2023 at 08:06 am

[Display]

Cars are often not financed with the help of savings, but with a car loan. In order for this to work, it is necessary to find a suitable loan. This can only be achieved through a comprehensive comparison of providers. Interested parties should take various aspects into account in order to find a really cheap loan offer that suits their individual needs. This article explains which points are particularly relevant when looking for a loan.

A loan for different purposes

Before the search for a suitable car loan can begin, various preliminary considerations must be made. This includes, among other things, the question of whether a new car or a used car should be purchased. Depending on the answer to this question, a higher or lower loan amount is required. In addition, it must be clarified whether the vehicle is to be used for private purposes or whether it is a company vehicle.

The next step is to consider how much space is required. How many people will be driving the vehicle at the same time and how much storage space will be needed in the trunk? It also needs to be clarified whether the car is about speed and performance or whether it should above all be suitable for everyday use and durable. Only those who know exactly what type of vehicle is to be financed can find a suitable loan.

Choose an appropriate budget

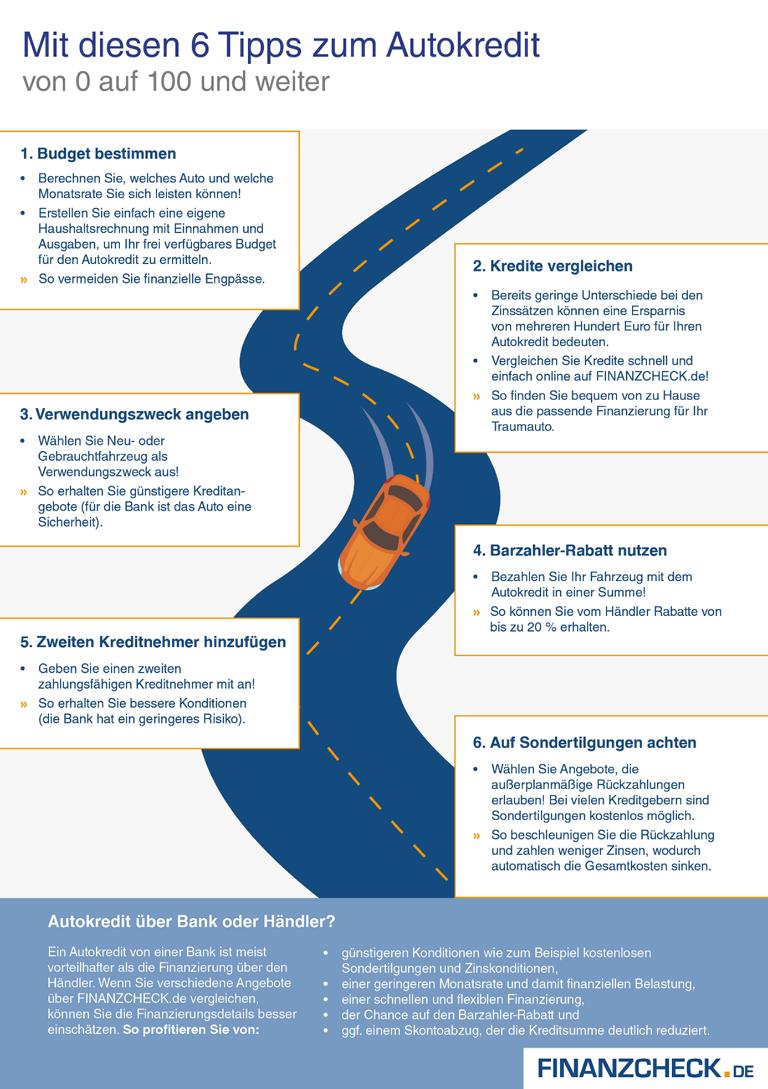

An important task when looking for a car loan is to determine your own budget exactly. Of course it's nice to dream of a vehicle that costs several hundred thousand euros. If your own budget doesn't allow it, you won't get the appropriate financing. It is therefore more efficient to consider exactly how much money you can raise monthly for the financing and which vehicles can be financed with this.

An individual household calculation is ideal for determining your own budget. This compares the regular income with the fixed costs. The amount that is left over is available monthly for various expenses. However, it should not be invested entirely in credit financing in order not to suffer financial bottlenecks. In addition, the selected loan amount should contain some buffers, since unexpected costs for any repairs or agent commissions may arise for a vehicle.

Make the loan comparison as broad as possible

It is a pleasant feeling when a loan is approved. One would prefer to accept the offer immediately and buy the car of their dreams. However, this is usually not useful. The house banks in particular often do not offer the most favorable loan terms. Therefore, their offers should not be accepted immediately. Instead, it makes sense to carry out a comprehensive loan comparison and obtain as much information as possible about individual offers.

Even during a phase of low interest rates, it is advisable to compare the offers of as many providers as possible. Even small differences in interest rates affect the cost of borrowing. An accurate comparison can often save consumers several hundred euros in costs. It is advisable to use online offers when looking for a suitable loan. On the one hand, the websites of the dealers can be visited, where numerous offers are available. There are also platforms and service providers where offers from different retailers can be compared and contrasted. This makes finding a loan and submitting an application quick, easy and convenient from home.

Car loan instead of discretionary credit

There are many different forms of credit that borrowers can choose from. For example, there are freely available loans that can be used as desired. However, this does not make sense when financing a car. Borrowers know exactly what they want to spend the money on and there is no benefit in keeping this a secret from the bank. On the contrary, it is advisable to indicate the intended use if it is known.

If the banks know what the loan amount is used for, their default risk decreases. Then they are often willing to provide favorable credit conditions. A car is also a valuable item. This can be deposited with the bank as security, which often reduces the borrowing costs even further. It therefore makes sense to take out a car loan instead of an disposable loan. The loan amount is then used specifically to finance the vehicle, and the transparency created in this way helps to reduce borrowing costs.

Benefit from a cash payment discount

Car dealers have an interest in getting the money for their vehicles in one fell swoop and in cash. If buyers do not opt for financing from the dealers, but put the purchase amount on the table, they are often offered favorable conditions. In many cases discounts of up to 20% are possible. With a professional car loan, this procedure is easily possible.

In order for this to work, it is important to start looking for a loan in good time. The loan amount must have already been approved and transferred when purchasing the car. Only then is it possible to pay the amount in cash and benefit from the cash discount. Borrowers should therefore take enough time to compare providers and submit the application, as there can always be delays if documents are missing or filled out incorrectly. Time pressure and stress when looking for a loan and car financing must be avoided at all costs.

Work with a second borrower

Basically, the lower the risk of default for banks and credit institutions, the more willing they are to offer favorable credit terms. Especially people who only have a medium to moderate credit rating and a rather low Schufa score should therefore try to improve their starting situation when looking for a loan.

One option is to bring a second borrower on board. They should be able to pay themselves and have a good credit rating. If the first borrower is no longer able to meet their loan obligations, the second borrower steps in. This means a significant increase in security for banks and credit institutions, which usually reduces credit costs.

Keep the possibility of special repayments open

It is advisable to take advantage of a loan offer that offers the option of making special repayments. Most dealers offer the option of making special repayments once a year. This option can be used, for example, if there was a salary increase, you won the lottery, there was an inheritance or in some other way more money is available than expected.

The special repayment reduces the remaining debt that the borrower still has with the bank or credit institution. In this way, less interest has to be paid on the loan and the loan is cheaper overall. It should be noted that most lenders set an upper limit for special repayments. It is therefore usually not possible to pay off the entire remaining debt in one go during the current fixed-interest period.

Take out the loan from the bank instead of from the dealer

Many car buyers find it convenient that the car dealers themselves offer car financing. They then do not have to deal with banks and credit institutions, but are offered the loan directly where they need it. This reduces bureaucracy and the effort involved in borrowing, which makes car financing particularly easy. However, there are several disadvantages associated with this method.

As a rule, car dealers only work with a few or even just one financing partner. Borrowers thus forgo the opportunity to obtain and compare many different offers. They are dependent on the conditions offered by the car dealer's contractual partner. This is not the case with banks. In addition, there is not always the possibility of special repayments with dealer loans. As a rule, it is therefore more worthwhile for borrowers to take out a car loan from a bank or credit institution than to use the dealer's offers.

Improve your credit rating

It doesn't matter whether a car is financed by a bank, a credit institution or a dealer, all financiers carry out a credit check. This means that they check the solvency of individual borrowers and whether they are always reliable in meeting their financial obligations. As a rule, the lenders request information from credit agencies such as the Schufa in order to use the financial data stored here to assess the applicants.

It is therefore a good idea to optimize the data stored at the credit agencies and, for example, improve the Schufa score. In this way improve borrowers' creditworthiness and increase their chances of getting a loan. This is achieved, among other things, by the fact that all incoming invoices are always paid on time and in full. In addition, borrowers should not use more bank accounts and credit cards than necessary. Otherwise it seems as if they can't cope with their finances and have to juggle in one place or another. The higher the Schufa score that prospective borrowers achieve, the higher the likelihood that a car loan will be approved.

Action helps

In the automotive industry, acting is part of the good manners. Especially if a used car is to be bought, there is often the possibility of reducing the price through clever action. But even with new cars, it is possible, within certain limits, to achieve individual adjustments through skillful action.

The same applies in principle to taking out a car loan. The banks and credit institutions set the framework in which the credit costs move. However, through individual adjustments and skillful action, it is possible to design the loan so that it suits your own wishes and ideas. Last but not least, this means that borrowing costs are falling.

Think about a possible rescheduling

When borrowing, it should be remembered that retraining may be necessary. This is the case, for example, when lending rates on the market drop significantly and the current loan agreement is suddenly disproportionately expensive. If the fixed-interest period is about to expire, the prepayment fees associated with such a debt restructuring are small. Therefore, a reasonable term for the fixed interest rate should be chosen when concluding the contract.

If interest rates on the market are expected to fall soon, a short-term fixed interest rate should be agreed. If, on the other hand, an interest rate increase is likely, a long fixed interest rate is worthwhile. Borrowers then continue to pay the favorable lending rates even if market interest rates rise.

Conclusion

With good research and some negotiation skills, it is easy to get a cheap and individual car loan. It is crucial that the borrowers have enough time to complete all the tasks that arise. In addition, they should realistically assess how much budget they have at their disposal and what their creditworthiness and the requirements for a loan are.

In this way, it is possible to choose a suitable loan and not to invest precious resources and energy in applications that are doomed to fail from the start. Especially in the online area, the search for a suitable loan is often quick and easy, so that the required loan amount is in the account promptly.

Are you planning to buy a new car and are you therefore looking for financing? Or should the modified baby and its attachments simply have the best possible insurance? Then ours Credit, financing, leasing, insurance & Co. categories exactly the right place to go for information. And also cheap financing for Accessory parts is there. Is the new one forged wheel, the planned Airride air suspension or the one you want foiling too expensive? Then a little one might help Financing in the process of implementing the modification on the vehicle. And also the topic Leasing or the vehicle sales are not neglected here. Just click through the posts and get the answer to your questions.

Of course, that wasn't the end of it!

tuningblog has countless posts on the topic Credit, financing, leasing, insurance & Co. in stock. Do you want to see them all? Just click HERE and look around. The following is an excerpt from the last contributions from this category:

other related posts

|

Reimbursement from the insurance company: this is how it works! |

tuningblog.eu Your magazine about tuning the car

tuningblog.eu Your magazine about tuning the car